modified business tax return instructions

The amended return must be filed within the time prescribed by law for the applicable tax year. The modified business tax covers total gross wages less employee health care benefits paid by the employer.

What Is Bonus Depreciation A Small Business Guide The Blueprint

Modified Adjusted Gross Income MAGI in the simplest terms is your Adjusted Gross Income AGI plus a few items like exempt or excluded income and certain deductions.

. Include a copy of the original return 2. File an amended return on Form 1120x by sending the return along with any schedules that changed to the address where you filed your original corporate tax. If you are using Chrome Firefox or Safari do NOT open tax forms directly from your browser.

Fill out Modified Business Tax Return General Businesses Form within a few minutes following the recommendations listed below. Line Instructions for Forms 1040 and 1040-SR. Modified Business Tax.

Line-through the original figures in black ink. Granholm July 12 2007 imposes a 495 business income tax and a modified gross receipts tax at the. Write the word AMENDED in black ink in the upper right-hand corner of the return.

The amended return must be filed within the time prescribed by law for the applicable tax year. For purposes of the PTC household income is the modified adjusted gross income modified AGI of you and your spouse if filing a joint return see Line 2a later plus the modified AGI of. INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - FINANCIAL BUSINESSES ONLY General Businesses need to use the form developed specifically for them TXR-02005 Line 1.

You must file a written statement with your original income tax return for the first tax year in which two or more activities are originally grouped into a single activity. Malt Beverage and Liquor Tax Forms. Keystone Opportunity Zone KOZ Forms.

Step-by-step Instructions to Help You Prepare and File Your Tax Amendment. Schedule C is included in your personal tax return Form 1040 or 1040-SR so to amend your business taxes you must amend your entire tax return. Modified Business Tax.

BUSINESS TAX GENERAL BUSINESS. MODIFIED BUSINESS TAX RETURN 1. SignNow combines ease of use affordability and security in one online tool all without forcing.

The amended return must include any resulting adjustments to taxable. Right click on the form icon then select SAVE TARGET. The Michigan Business Tax MBT which was signed into law by Governor Jennifer M.

Ad Fast Easy Secure. The Nevada Modified Business Return is an easy form to complete. Total gross wages are the total amount of all gross wages and.

It requires data and information you should have on-hand. INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - FINANCIAL BUSINESSES ONLY General Businesses need to use the form developed specifically for them TXR-02005. Individual Tax Return and Extensions stylesheets can be downloaded for use in displaying XML tax return data and are located on the MeF Stylesheets page.

You will need to use Form. Credits - Enter amount of overpayment of Modified Business Tax made in prior reporting periods for which. BUSINESS TAX MINING RETURN This form is a universal form that will calculate tax interest and penalty for the appropriate periods if used on-line.

Gross wages payments made and individual employee. Pick the document template you need from the collection. Line Instructions for Forms 1040 and 1040-SR.

Social Security Number SSN Dependents Qualifying Child for Child Tax Credit and Credit for Other. Signature Date 1 to 10 11 to 15 16 to 20 21 to 30 31 15. Instructions contains information about how to complete each label on the company tax return including company information Items 130 the calculation statement and declaration.

Amended Tax Filing Service. Calculated Tax - Add Line 7 plus Line 8 and enter the Calculated Tax. Modified business tax return nevadall solution to design nevada modified business tax form.

PREVIOUS DEBITS Outstanding liabilities AMOUNT.

3 11 16 Corporate Income Tax Returns Internal Revenue Service

New Irs Announces 2018 Tax Rates Standard Deductions Exemption Amounts And More

Publication 974 2021 Premium Tax Credit Ptc Internal Revenue Service

Instructions For Form 1040 Nr 2021 Internal Revenue Service

Instructions For Form 5471 01 2022 Internal Revenue Service

Qbi Deduction Frequently Asked Questions K1 Qbi Schedulec Schedulee Schedulef W2

Form 8995 A Schedule C Loss Netting And Carryforward K1 Schedulec Schedulee Schedulef

3 12 16 Corporate Income Tax Returns Internal Revenue Service

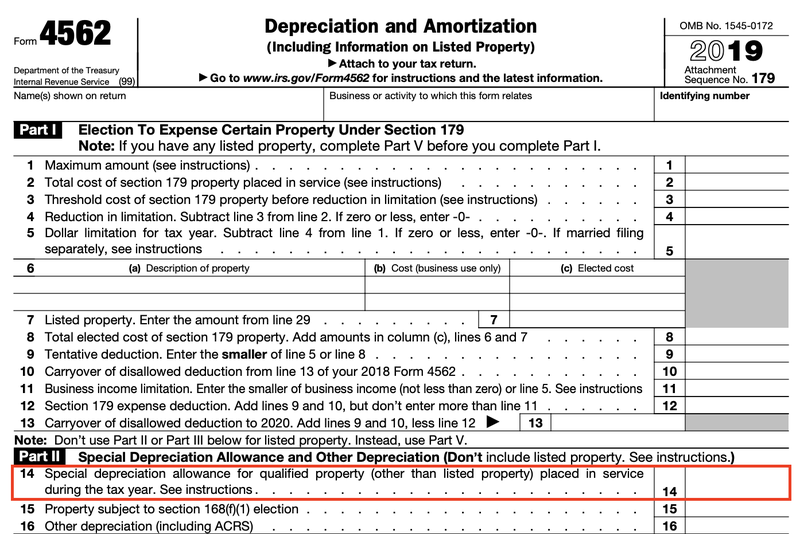

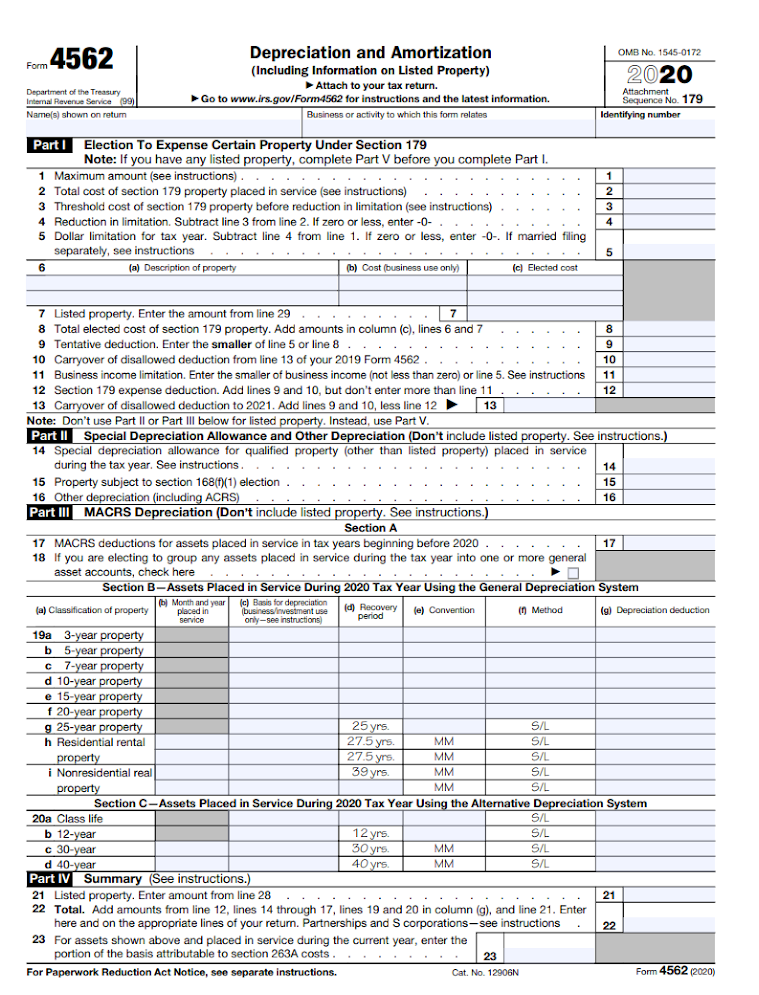

Irs Form 4562 Explained A Step By Step Guide

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)